Notification

Show More

Latest News

চালু হচ্ছে ইউনিক কর নম্বর: এক নিবন্ধনেই আয়কর–ভ্যাট

Dec 10, 2025ভ্যাট দিবস ও ভ্যাট সপ্তাহ, ২০২৫ উদযাপন করছে

Dec 10, 2025কেন আয়কর রিটার্ন নিরীক্ষায় পড়ে?

Nov 28, 2025আয়কর রিটার্ন দাখিলের ক্ষেত্রে যেসব বিষয় খেয়াল রাখতে

Nov 28, 2025Police Supports Peaceful Protestors in Los Angeles

Jun 21, 2022It Possible to Re-Open Schools in Spring 2021?

Jun 21, 2022Demographic Crisis After the Pandemic

Jun 21, 2022Social and Economic Equality

Jun 21, 2022Everything Was Wrong with Election 2020

Jun 21, 2022Top 5 Reasons to Go Outside

Jun 21, 2022The Pressure of “Trumpism”: How It Has Set

Jun 21, 2022Should the Impeachment Trial Be Changed?

Jun 21, 2022Food allergy prevent startup Set

Jun 21, 2022Food allergy prevent startup Set, Food raises

Jun 21, 2022Bell’s Naked Chicken Chal is Back on

Jun 21, 2022Avocado consum hits record highs, driven by health

Jun 21, 2022Big Food hit pause switching to natural

Jun 21, 2022Food unlocks secret to healthy eating and

Jun 21, 2022Instant Pot Recipes That Make Meals Lot Easier

Jun 21, 202219 Cold Soup Recipes for Hot Summer Days

Jun 21, 2022Making Chocolate Cake Recipes From Scratch

Jun 21, 2022The Top Secrets Of The Perfect Weight Loss

Jun 21, 2022What if I have no experience design copywrite?

Jun 20, 2022How do I get started Locking and Unlock

Jun 20, 2022In the 1930s, as today, the shift to

Jun 20, 2022In the 1930s, as today, the shift to

Jun 20, 2022The Free AI Copywriting Tool For Everything?

Jun 20, 2022The Free AI Copywriting Tool For Everything

Jun 20, 2022African ations Are Singing To Save Their Wildlif

Jun 20, 2022What if I have no experience design copywrite?

Jun 20, 2022Finally found a work computer That’s practicall

Jun 20, 2022The Best Ways to Start aMotoport Rider Career

Jun 20, 2022How childhood infectionsmay year 2021 Section

Jun 20, 2022Squarespace is the platfo build beautiful website.

Jun 20, 2022Increase traffic your blog with Squarespace mail

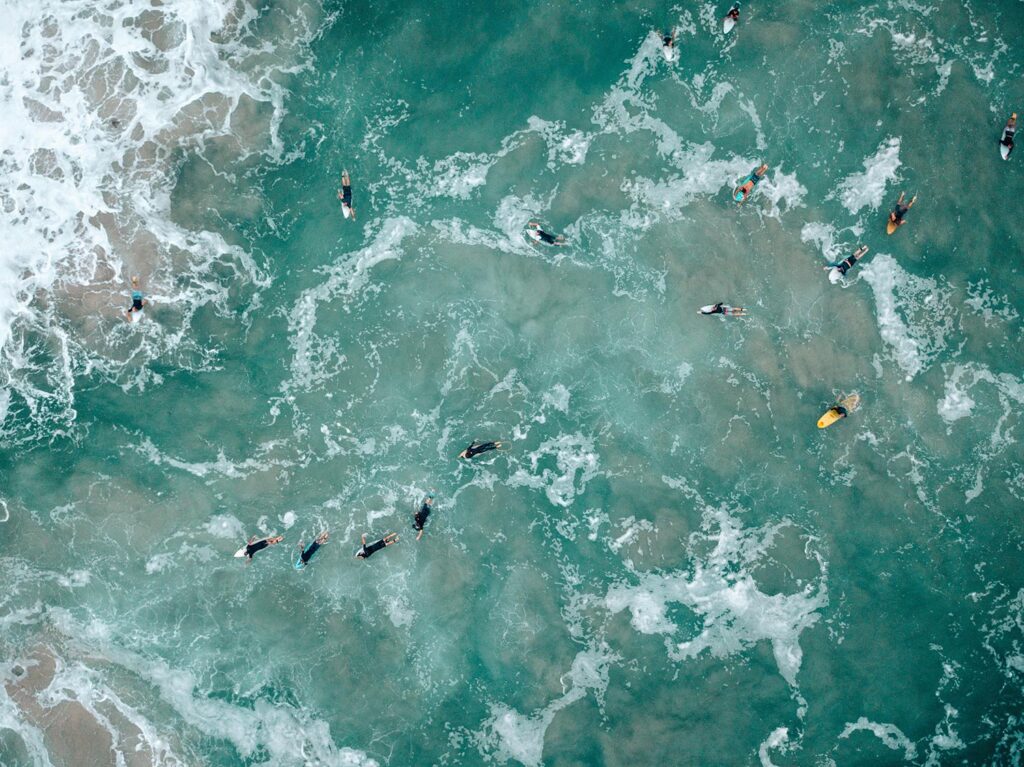

Jun 20, 2022Travelling as a way of self discovery and

Jun 20, 2022How to choose the right customer for your

Jun 20, 2022How to optimize images in Word for faster

Jun 20, 2022Runtastic is a blog powered by adidas that

Jun 20, 2022One play off semi-final triumph, as well

Jun 20, 2022Finally found computer That’s practically

Jun 20, 2022Aston Villa Welcome Liverpool In The Premier League

Jun 20, 2022Were The 2021 Bengals a fluke or a

Jun 20, 2022the secret of BuzzFeed’s success has a lot

Jun 14, 2022Blogging may be a fun hobby for Tumblr

Jun 14, 2022Have a look through a handful of the

Jun 14, 2022The most popular news blogs on the internet

Jun 14, 2022Your customers care about. For example, as and

Jun 14, 2022Marketing agency, some of our content clusters are

Jun 14, 2022It’s good for SEO to create content clusters

Jun 14, 2022To nurture people in this stage you should

Jun 14, 2022Develop deeper relationship With each

Jun 14, 2022ptimized. To rank in the SER search engine

Jun 14, 2022Finally found Pc Programm That’s practically perfect

Jun 14, 2022Provide the insight and support needed to

Jun 09, 2022Provide the insight and support needed to

Jun 09, 2022A great experience goes beyond the purcha

Jun 09, 2022There are several differences between outbound and

Jun 09, 2022stomer succeed and maintain a valuable relationship.

Jun 09, 2022The heart of inbound marketing helping

Jun 09, 2022Inbound marketing is a marketing approach

Jun 09, 2022Your Buyers and Building Target Account Tol

Jun 09, 2022with useful content and experiences tailored

Jun 09, 2022How To Organize And Write Content For

Jun 09, 2022including io9, Jezebel Lifehacker More

Jun 09, 2022before he was sought out by Weblogs Inc.

Jun 09, 2022Gizmodo was launched in 2002 by Peter Rojas

Jun 09, 2022Formerly the Gaw Media network,Internet

Jun 09, 2022reviews, and features on about technology.

Jun 09, 2022talented team helps prod some of the best

Jun 09, 2022he most popular blogs on the web today.

Jun 09, 2022It now runs on the free blogging platform

Jun 09, 2022the blog include climate politics, lgbq issue,

Jun 09, 2022onprofit organization that seeks provide inform

Jun 09, 2022he most popular blogs onthe web today.

May 25, 2022which has grown to takeits place among the

May 25, 2022Next Web Conference which was initially

May 25, 2022The blog was launched asresult organizing

May 25, 2022It now attracts over one million ever visitors

May 25, 2022Trending Topics

Most Reading

Apply For Breaking News

Published Video

International News

Trending Topics

Trending Topics

Selected News

Travel Blogs

Online Voating

This may be the latest case of post aggression emigration in Ukraine. But it is unlikely to be the final stage for millions of people to leave the country. These people do not want

YES55%

NO50%

English

English